A Strong Start: Baird Small/Mid Cap Growth Fund Celebrates 3 Years

Asset Management,Firm

Baird’s Small/Mid Growth Fund (BSGIX/BSGSX) recently passed its three-year anniversary delivering strong, returns since inception. Additionally, the fund has seen strong growth in assets under management and is now more than $150 million. Highlights include:

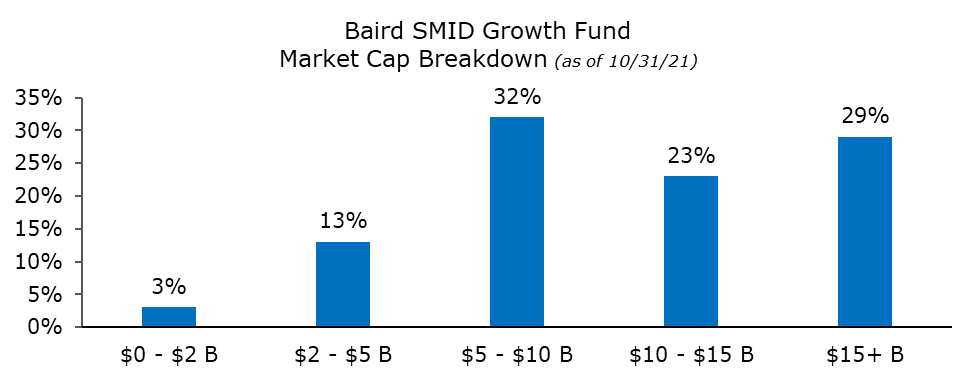

- True “smid” portfolio with exposure to both small- and mid-cap growth stocks

- Concentrated portfolio, differentiated from its benchmark

- Leverage a proven philosophy and process; led by Jonathan Good and backed by Baird's U.S. Growth team

We took the time to ask lead portfolio manager, Jonathan Good, a few questions:

Why did you Start the Small/Mid Cap Growth Fund?

Launching the Small/Mid Cap Growth Fund was a natural extension for the team. We were already researching smaller companies as we looked for those that might be candidates for our mid cap growth fund. But as the definition of “mid cap” gets bigger every year, many smaller companies no longer fit that strategy. This asset class gives us the ability to invest in those companies sooner. The Strategy is also style pure with true exposure to both small- and mid-cap stocks, with high conviction (60-70 holdings) and high active share. Similar to our mid cap growth strategy, we strongly believe in our ability to drive long-term outperformance in the SMID asset class.

Tell us about your investment approach for the Baird Small/Mid Cap Growth Fund - what are important characteristics of the types of companies you invest in?

Our investment process and philosophy for smid is identical to how we’ve approached our midcap fund for the last 20 years. We do rigorous research to ensure a high-quality portfolio which to us means companies that have clear advantages – more profitable, faster growing and better financed than their peers – and we stay true to our investment principals regardless of the environment. We do not make big sector bets and have a mix of both unique high-growth secular stocks as well as companies that we think can compound earnings growth over the next several years.

You describe the Small/Mid Growth Fund as “playing to your strengths.” Would you describe that in more detail?

We have a focused, stable, and experienced investment team with all resources and effort dedicated to a singular investment style, high-quality growth. Our team is composed of industry veterans that have deep institutional knowledge of small- and mid-cap companies, as well as having spent the majority of their careers in the sectors they currently cover. Given the strong historical presence in each of their areas, our Portfolio Managers/Analysts have developed a strong network of industry contacts and expertise that lead to high conviction recommendations. Our investment team also has significant history together. We work incredibly hard to foster a team structure and culture that promotes collaboration, robust dialogue, and efficient decision-making. Finally, being able to leverage the resources of Baird is a competitive edge, and the firm’s strong brand and reputation helps us attract and retain top talent.

How has the Fund performed since launching it three years ago?

We are very proud of the track record we've built for both the Baird Small/Mid Growth Fund and the Baird Small/Mid Growth Strategy (6 Years). Over this time frame we’ve encountered multiple different market environments and know how our portfolio performs in both bull and bear markets. We strive to deliver consistent relative outperformance over the long term. We believe our portfolios have the potential to exceed benchmark returns in most years without having to take on extra risk via large, concentrated position sizes or outsized sector bets.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment in the fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The funds' current performance may be lower or higher than the performance data quoted.

Investors should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. This and other information can be found in the prospectus or summary prospectus. A prospectus or summary prospectus may be obtained by visiting bairdfunds.com. Please read the prospectus or summary prospectus carefully before investing.

The Fund focuses on growth-style stocks and therefore the performance of the Fund will typically be more volatile than the performance of funds that focus on types of stocks that have a broader investment style. The Fund may invest up to 15% of its total assets in U.S. dollar-denominated foreign securities and ADRs. Foreign investments involve additional risks such as currency rate fluctuations, political and economic instability, and different and sometimes less strict financial reporting standards and regulation. The Fund invests a substantial portion of its assets in the stocks of small- and mid-capitalization companies. Small- and mid-capitalization companies often are more volatile and face greater risks than larger, more established companies.

The Net Expense Ratio is the Gross Expense Ratio minus any reimbursement from the advisor. The advisor has contractually agreed to waive its fees and/or reimburse expenses at least through April 30, 2022, to the extent necessary to ensure that the total operating expenses do not exceed 1.20% of the Investor Class's average daily net assets and 0.95% of the Institutional Class's average daily net assets. Investor class expense ratios include a 0.25% 12b-1 fee.

The Russell 2500 Growth Index measures the performance of those Russell 2500 companies with above average price-to-book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000 Growth Index. Indices are unmanaged and are not available for direct investment.