Important Disclosures

Investors should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. This and other information is found in the prospectus and summary prospectus. For a prospectus or summary prospectus, contact Baird directly at 866-442-2473. Please read the prospectus or summary prospectus carefully before investing.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment in the fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The funds' current performance may be lower or higher than the performance data quoted.

Chautauqua Capital Management obtained some information used in this presentation from third party sources it believes to be reliable, but this information is not necessarily comprehensive and Chautauqua Capital Management does not guarantee that it is accurate. Neither Chautauqua Capital Management, its affiliates, directors, officers, employees or agents accepts any liability for any loss or damage arising out of your use of all or any part of this presentation. There is no guarantee the Fund will meet its investment objectives. All investments involve risk, including the possible loss of principal. Asset allocation and diversification do not ensure a profit or protect against a loss. There is no assurance that any investment strategy will be successful or that any securities transaction, holdings, sectors or allocations discussed will be profitable.

Graphs or other illustrations are provided for illustrative purposes only and not intended as a recommendation to buy or sell securities displaying similar characteristics.

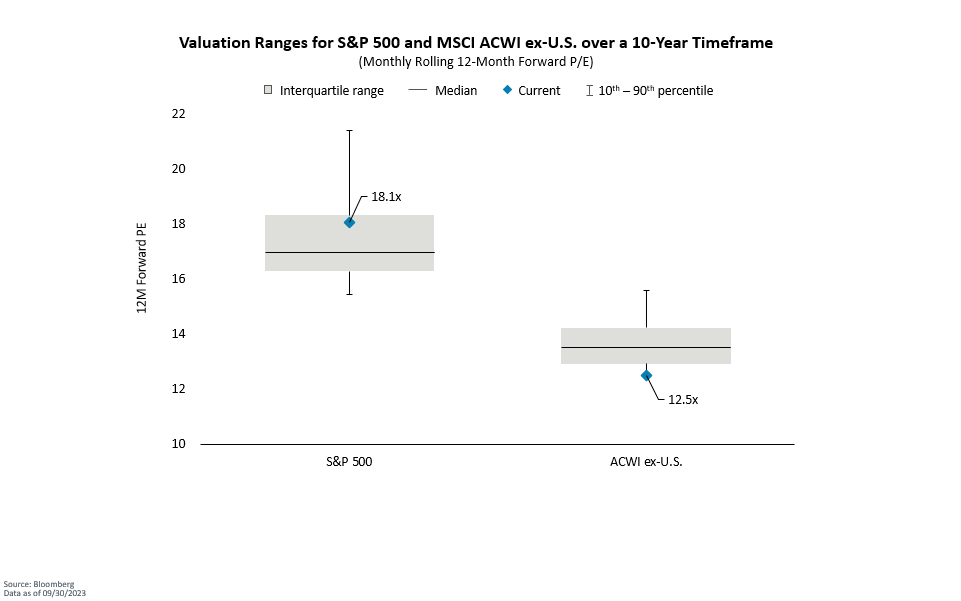

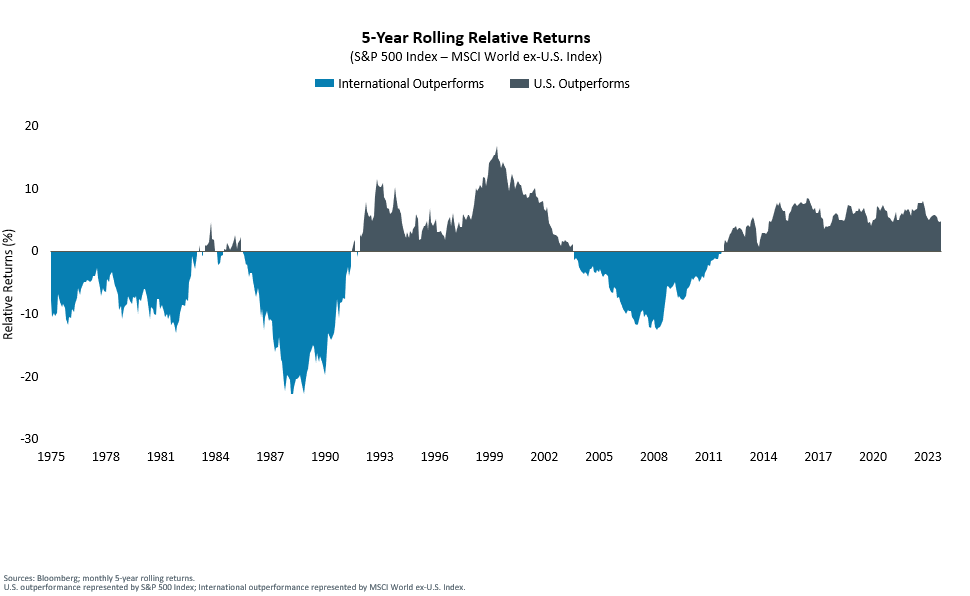

The Standard & Poor's 500 Index (S&P 500) is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities.

The MSCI World ex-U.S. Index® is a free float-adjusted market capitalization weighted index that captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries excluding the United States.

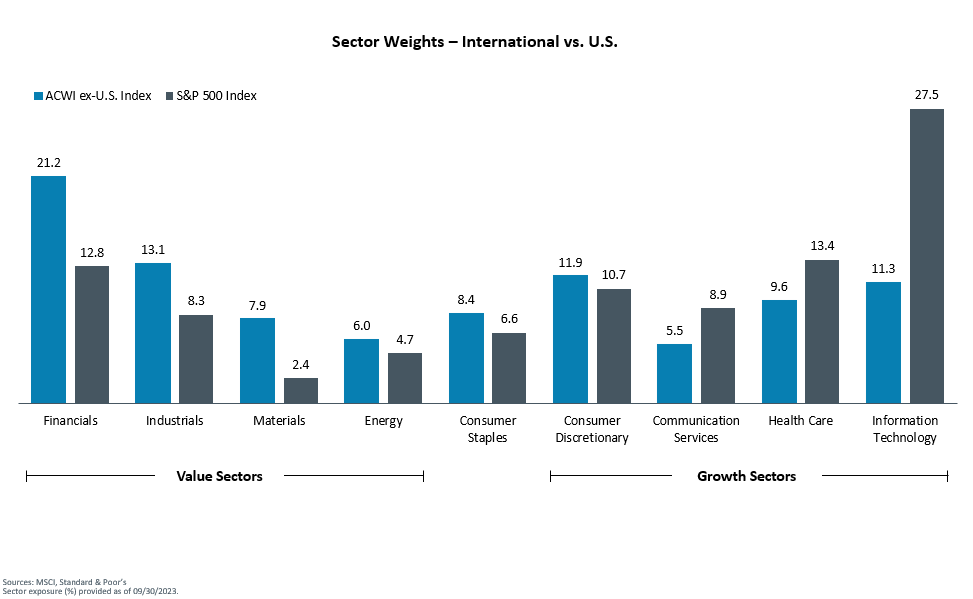

The MSCI ACWI ex-U.S. Index® is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the United States. The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties or originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The 2019 Vanguard report referred to was titled "Global equity investing: The benefits of diversification and sizing your allocation."